Contents

HDFC home loan calculator can be done in a number of ways. These include EMI and Prepayment options, Interest rates and property costs. You can also use the calculator to compare loans to find the best one. Ultimately, this tool can help you find a home loan that will fit your financial goals.

Interest rate on HDFC home loan

The interest rate on HDFC home loan varies depending on the type of loan and the amount borrowed. You can also opt for an HDFC Ltd loan if you are self-employed. The interest rate on this loan depends on your profession, gender and the loan amount. However, you must bear in mind that the interest rate may increase or decrease by up to 0.25% on a monthly basis.

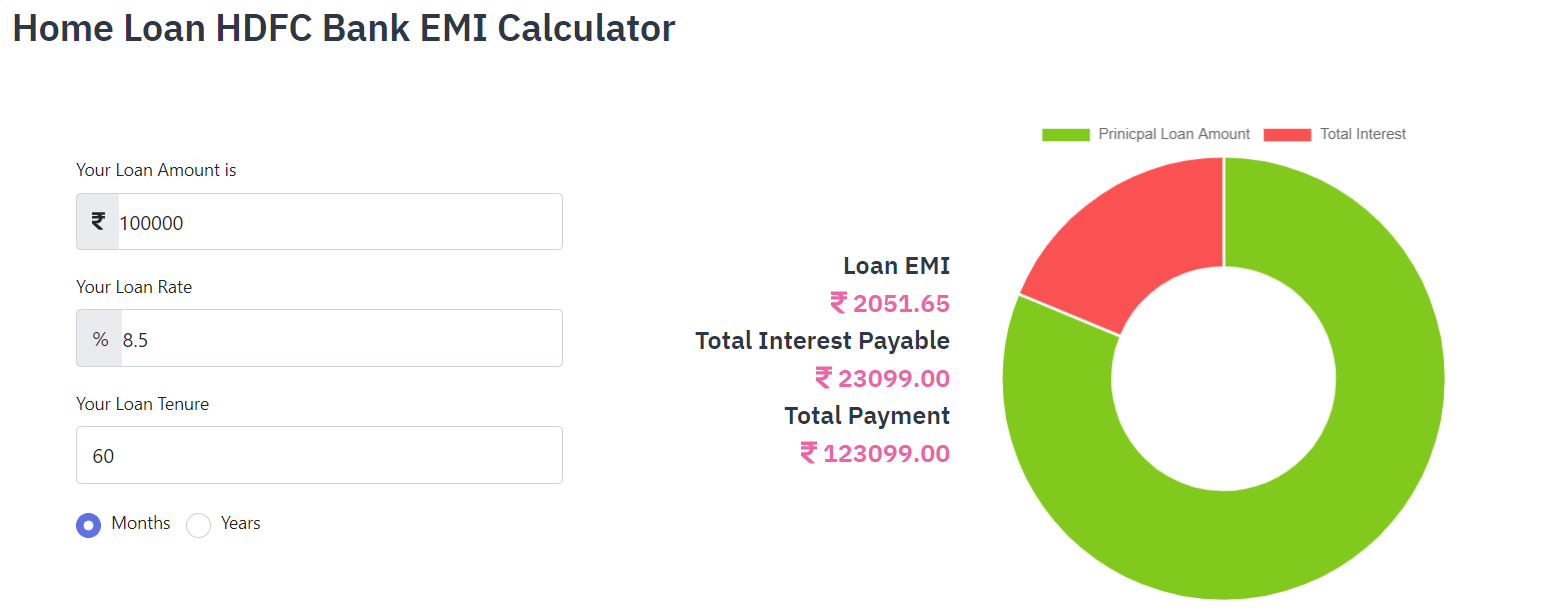

To get the EMI amount, you can consult a HDFC home loan calculator. This calculator will give you the EMI amount based on your monthly income and loan tenure. A home loan EMI calculator will also show the interest rate on a HDFC home loan in terms of the maximum tenure and the amount of loan you are eligible to borrow.

Property cost

When applying for a home loan with HDFC bank, you need to know how much the property is worth. This will help you understand how much you can borrow and what your repayment plan should be. HDFC home loans are available in various amounts, ranging from one lakh to ten crore, and can be taken for one year or thirty years. HDFC home loans are usually subject to a 7.65% interest rate and require a minimum credit score of 800.

You can use HDFC home loan calculator to find out the exact loan amount you can afford. This tool works fast and accurately to the last digit. You can also use it to compare different loan amounts and tenures. This will help you choose the amount you can afford to pay over time, based on your income and repayment capacity.

EMI options

HDFC home loans have made it possible for millions of Indians to buy their dream homes. They are offered to salaried and self-employed individuals as well as NRIs and farmers. HDFC home loan EMI calculators help prospective borrowers understand their EMI amounts and tenure. It’s important to know the amount of each EMI to ensure a smooth repayment of the loan.

HDFC home loans are easy to obtain and offer low interest rates. They also follow a transparent process with no hidden fees or charges. In addition, HDFC offers pre-approved loans for specific customers with excellent credit scores. They also offer many types of home loans, balance transfers, and flexible repayment options.

Prepayment options

HDFC home loan prepayment options allow customers to repay their home loans early, saving a significant amount of interest. This option is available to customers with a fixed or floating rate of interest. Customers can pay off their loans early by making additional EMI payments. These payments can be made using net banking or auto-debit.

When considering prepayment options, it’s important to consider your financial situation and your financial goals. If you have surplus funds available to meet other financial goals, a prepayment may make sense. However, you should avoid extending yourself too far if you don’t have enough funds to meet any unforeseen financial obligations.

Ease of use

An HDFC home loan calculator is a useful tool to figure out the EMIs and repayment period of your loan. It can also calculate the actual interest component of the loan. With this tool, you can decide what size of loan you need before selecting a property.

A HDFC home loan calculator is easy to use. You simply need to enter your loan amount, interest rate, and tenure, and you can get your EMI figure in a few seconds. The calculator is free and you can use it unlimited times.

Requirements to apply for HDFC home loan

HDFC home loan is a loan that is designed to help people buy a home. However, there are several requirements that applicants need to meet before they can obtain the loan. Listed below are some of these requirements. To apply for a HDFC home loan, you must have a stable source of income.

HDFC home loan can be applied online or offline. Online applications can be completed through a bank or a marketplace. If you prefer to apply offline, you can visit an HDFC branch office. The representative will walk you through the application process. Then, you will need to submit a set of documents to prove that you meet the requirements for the loan.